Why Life Insurance Is So Important

Why Life Insurance Is So Important? It’s a question that deserves careful consideration. Life insurance isn’t just about finances; it’s about safeguarding your loved ones and ensuring a secure future. This comprehensive guide explores the multifaceted benefits of life insurance, from providing financial protection to facilitating estate planning and achieving personal goals. Understanding the various types of policies, associated costs, and the long-term implications is crucial for making informed decisions.

This guide will detail the various types of life insurance policies, their features, and benefits. It will also cover the financial protection it offers in case of unforeseen events, its role in estate planning, and how it can be tailored to individual needs and goals. Furthermore, the importance of considering costs, affordability, and long-term financial security will be highlighted.

Defining Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company (the insurer). Its core purpose is to provide a financial safety net for loved ones in the event of the policyholder’s death. This financial protection ensures that beneficiaries receive a predetermined sum of money, mitigating potential financial hardship resulting from the policyholder’s absence. This security is crucial for supporting dependents, paying off debts, and covering funeral expenses.Life insurance safeguards the financial future of those relying on the policyholder.

It acts as a crucial component of a comprehensive financial plan, providing peace of mind for both the policyholder and their beneficiaries.

Types of Life Insurance Policies

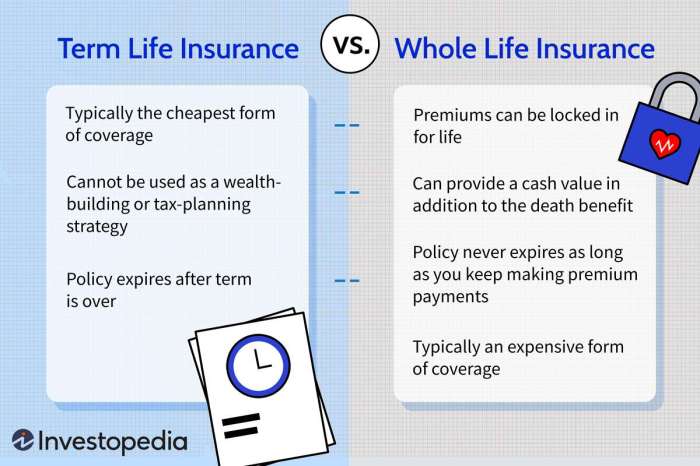

Different life insurance policies cater to various needs and financial situations. Understanding the characteristics of each type is essential for making informed decisions. The two primary types are term life and whole life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period (the term). If the policyholder dies during the term, the beneficiaries receive a payout. Premiums are typically lower compared to other types, reflecting the limited duration of coverage. This makes it an attractive option for those seeking temporary protection for a particular life stage, such as raising children or paying off a mortgage.

Whole Life Insurance

Whole life insurance offers lifelong coverage, continuing until the policyholder’s death. This type often includes a cash value component that grows over time. Premiums are generally higher than term life premiums due to the longer coverage period and the inclusion of cash value accumulation. This cash value component can potentially be borrowed against or used for other financial needs.

Comparison of Life Insurance Policies

| Policy Type | Coverage | Premiums | Cash Value |

|---|---|---|---|

| Term Life | Coverage for a specified period (e.g., 10, 20, or 30 years). | Generally lower than whole life premiums. | No cash value component. |

| Whole Life | Lifelong coverage. | Generally higher than term life premiums. | A cash value component that grows over time. |

Financial Protection

Life insurance provides a vital safety net, safeguarding the financial well-being of loved ones when the unexpected occurs. It offers a crucial layer of protection against the substantial financial burdens that can arise from the death of a breadwinner. This protection extends beyond immediate expenses, ensuring long-term stability for dependents and mitigating the impact of loss.

Protecting Loved Ones Financially

Life insurance acts as a financial shield, ensuring that the deceased’s loved ones are not left to grapple with immediate and long-term financial difficulties. This financial support is essential for covering various expenses, maintaining a stable lifestyle, and providing for dependents.

Funeral Expenses

Funeral expenses can be a significant financial strain, often exceeding expectations. Life insurance can directly address these costs, relieving the family of this immediate burden. Having pre-arranged coverage for funeral expenses ensures that arrangements can be made without the added stress of immediate financial concerns.

Outstanding Debts

Unforeseen circumstances can leave families with substantial debts to manage. Life insurance proceeds can be used to settle outstanding mortgages, loans, credit card balances, and other financial obligations. This can help alleviate the pressure on grieving families, allowing them to focus on the emotional aspects of loss.

Supporting Dependents

In cases where the deceased was the primary income earner, life insurance provides a critical source of support for dependents, such as children or a spouse. The policy’s payout can help them maintain their standard of living, cover essential expenses, and navigate the transition period. For example, a policy payout can cover the costs of education for children, ensuring their future is secure, or provide a steady income for a spouse to adjust to a new financial reality.

Financial Burden of Losing a Primary Income Earner

The loss of a primary income earner can create a significant financial gap. Life insurance acts as a buffer, mitigating the financial impact of this loss. The policy payout can provide a crucial financial cushion, helping the family to manage everyday expenses and cover potential gaps in income.

Scenarios Where Life Insurance Provides Crucial Protection

- A young professional dies unexpectedly, leaving a spouse and two young children. Life insurance provides a crucial source of income to cover housing, food, and childcare, ensuring the children’s education is not interrupted.

- A business owner dies, leaving behind outstanding business debts and obligations. Life insurance can cover these debts, preventing the business from collapsing and protecting the employees’ jobs.

- A single parent dies, leaving a minor child. Life insurance ensures that the child has financial support for housing, education, and healthcare until they reach adulthood.

- A stay-at-home parent dies, leaving a spouse who is now responsible for all household expenses and potentially, the costs of childcare. Life insurance provides crucial support for the surviving spouse.

- A retiree dies, leaving behind substantial outstanding medical bills. Life insurance helps cover these expenses and avoids financial hardship for the family.

Estate Planning

Life insurance plays a crucial role in estate planning, facilitating a smooth transfer of assets and minimizing potential tax burdens. It acts as a vital tool for managing wealth across generations, ensuring financial security for beneficiaries and fulfilling specific legacy goals. Proper integration of life insurance into an estate plan is essential for maximizing its benefits.

Role of Life Insurance in Wealth Transfer

Life insurance proceeds can be a significant component of an estate, providing a substantial lump sum to beneficiaries upon the policyholder’s death. This influx of funds can help offset estate taxes, allowing for a more seamless transition of assets. It can also be a vital resource in covering outstanding debts, such as mortgages or loans, and providing financial support for dependents.

Reducing Estate Taxes

Life insurance can significantly reduce the estate tax burden. By utilizing policies with death benefits exceeding the estate tax exemption, beneficiaries receive the payout tax-free. This strategy can be particularly beneficial for individuals with substantial assets, ensuring a greater portion of their estate is available for beneficiaries.

Funding Charitable Donations and Legacy Goals

Life insurance can be a powerful tool for funding charitable donations or other legacy goals. Policies can be structured to direct a portion of the death benefit to specific charities or philanthropic endeavors, allowing individuals to contribute to causes they care about. This provides a tangible way to fulfill philanthropic aspirations and establish a lasting impact. For example, a policy could be structured to fund scholarships for students or support environmental conservation efforts.

Integrating Life Insurance into an Estate Plan: A Step-by-Step Guide

- Assessment of Existing Assets and Liabilities: A comprehensive inventory of assets, including real estate, investments, and personal property, is crucial. Similarly, evaluating outstanding debts and potential estate tax implications is vital for strategic planning. This step ensures a clear understanding of the estate’s current financial landscape.

- Determining Estate Tax Implications: Understanding the applicable estate tax laws and exemptions is essential for minimizing potential tax burdens. This step involves consulting with an estate planning attorney to accurately assess the estate’s tax liability. The attorney will provide guidance on optimizing the estate plan to minimize tax implications.

- Selecting Appropriate Life Insurance Policies: Choosing the right life insurance policies involves careful consideration of coverage needs and potential tax advantages. Factors such as coverage amount, premium affordability, and the policy’s death benefit structure should be taken into account. A review of various policy options, such as term life insurance and permanent life insurance, will assist in making informed decisions.

- Integrating Policies into the Will: The will must clearly Artikel how life insurance proceeds will be distributed. Beneficiaries and their respective shares should be explicitly stated, ensuring a transparent and legally sound process for the disbursement of the funds. This ensures the beneficiaries receive the intended portions of the death benefit.

- Reviewing and Updating the Plan Regularly: Life circumstances and financial situations change over time. Regular review and updating of the estate plan, including life insurance policies, is essential to ensure the plan remains aligned with current goals and circumstances. This process ensures the plan remains effective throughout life’s transitions.

Personal Needs and Goals

Life insurance is more than just a financial product; it’s a tool for securing your future and achieving your personal aspirations. Understanding how it can address individual needs and contribute to specific goals is crucial for making informed decisions. It’s a way to protect your loved ones and yourself from the financial consequences of unexpected events.Tailoring a life insurance policy to your specific circumstances is paramount.

Different individuals have diverse financial obligations and ambitions, necessitating a customized approach. This section will detail various personal needs addressed by life insurance, illustrating how it can be adapted to specific situations and support the attainment of personal financial objectives.

Different Personal Needs Addressed by Life Insurance

Life insurance addresses a multitude of personal needs, providing financial protection and security. These needs vary depending on individual circumstances, family obligations, and aspirations.

- Financial Security for Dependents: Many individuals have dependents, such as children or spouses, who rely on their income. Life insurance can provide a financial cushion to ensure their well-being in the event of the policyholder’s untimely demise. This security can cover ongoing expenses like housing, education, and daily necessities.

- Debt Repayment: Outstanding debts, including mortgages, student loans, or personal loans, can be substantial financial burdens. Life insurance can be structured to cover these debts, eliminating the financial strain on surviving family members.

- Funding Children’s Education: A significant life goal for many is funding their children’s education. Life insurance can be a vital tool in securing educational funds, ensuring children can pursue their desired academic paths without the financial stress of accumulating debt.

- Retirement Planning: Life insurance can supplement retirement savings, providing a substantial lump sum to maintain a desired standard of living in retirement. This is especially helpful in situations where retirement funds are insufficient to cover anticipated expenses.

- Supporting Special Needs: Individuals with special needs require unique financial planning. Life insurance can help support ongoing care and medical expenses, ensuring their well-being is adequately addressed.

Tailoring Life Insurance to Specific Circumstances

Life insurance policies can be tailored to accommodate diverse circumstances, ensuring a suitable fit for each individual’s unique needs. Flexibility is key in creating a policy that addresses specific financial requirements.

- Young Families: Young families often face significant financial responsibilities, such as mortgages, childcare, and education expenses. Life insurance tailored to this phase of life can provide a safety net, ensuring financial stability for the family should the primary income earner pass away prematurely.

- Business Owners: Business owners face unique financial risks. Life insurance can be a crucial tool to ensure business continuity and provide funds for debt repayment, employee compensation, or other essential business needs.

- Individuals with High Risk Profiles: Certain individuals may have higher health risks. Life insurance can still be obtained through various options, such as higher premiums or specific policy provisions, enabling them to gain financial protection.

Achieving Personal Financial Goals with Life Insurance

Life insurance plays a vital role in achieving personal financial goals. It provides a structured approach to securing future financial stability.

- Funding Children’s Education: A life insurance policy can be designed to accumulate a significant sum over time, which can be used to cover the costs of college tuition, reducing the financial burden on the family.

- Ensuring Retirement Security: Life insurance can serve as a supplement to retirement savings, creating a financial safety net that allows for a comfortable retirement, especially when coupled with a retirement plan.

- Addressing Unique Circumstances: Life insurance can help families who have unique circumstances, like significant debt or special needs, to provide a financial safety net and support the ongoing needs of the family or individual.

Choosing the Right Policy

Selecting the appropriate life insurance policy is a critical step in securing your financial future and protecting your loved ones. Carefully considering various factors, such as coverage amounts, premiums, and policy terms, is paramount. Understanding policy exclusions and limitations will help you make an informed decision.

Factors to Consider

Choosing the right life insurance policy involves evaluating several key factors. These factors include your financial situation, personal needs, and future goals. Analyzing these elements will ensure you select a policy that aligns with your specific circumstances. Ultimately, the policy you choose should provide adequate coverage while remaining affordable.

- Financial Situation: Assessing your current income, expenses, and debts is crucial. Consider how much you can comfortably afford to pay in premiums without compromising your financial stability. For example, a young professional with a stable income might opt for a higher coverage amount and a more comprehensive policy compared to someone with more financial obligations and less disposable income.

- Personal Needs: Evaluate your current financial obligations, such as mortgages, student loans, or other debts. Think about the financial support your loved ones might require in case of your untimely demise. Consider your family’s future needs and how the policy can help them cope with the financial repercussions of your absence. For instance, a family with young children might require higher coverage to cover educational expenses or future needs.

- Future Goals: Consider your long-term financial goals, such as retirement planning, education funds, or estate creation. Life insurance can play a crucial role in achieving these objectives. A policy designed to support future educational needs, for instance, could provide funds for a child’s college education.

Evaluating Coverage Amounts, Premiums, and Policy Terms

Understanding the coverage amount, premiums, and policy terms is vital for making an informed decision. Compare policies from different providers to determine the most suitable option.

- Coverage Amounts: Calculate the amount of coverage you need to protect your loved ones. This calculation should take into account your financial obligations and future needs. Consider factors like outstanding debts, future expenses, and potential financial support requirements for your family. A realistic estimate is key.

- Premiums: Compare the premiums of different policies. Choose a policy that fits within your budget and financial capabilities. Evaluate the long-term cost of the policy and consider potential increases in premiums over time. Look for options with affordable premiums and consider the impact on your overall financial plan.

- Policy Terms: Evaluate the policy’s duration and terms. Assess the benefits and drawbacks of different policy terms. Consider factors such as renewability, convertibility, and cash value accumulation potential. A long-term policy might offer more comprehensive coverage, but it might also have higher premiums.

Understanding Policy Exclusions and Limitations

Carefully review the policy’s exclusions and limitations to avoid any unforeseen issues. Thorough analysis of these aspects ensures the policy effectively meets your needs.

- Policy Exclusions: Understand the conditions that may not be covered by the policy. Examples of exclusions might include pre-existing conditions or specific activities. Review the exclusions carefully to identify any potential gaps in coverage.

- Policy Limitations: Be aware of the limitations of the policy, such as coverage amounts, waiting periods, or specific situations. Understanding these limitations will prevent any surprises or disappointments later. A detailed review of limitations will help avoid unexpected issues during a claim process.

Decision Tree for Choosing a Life Insurance Policy, Why Life Insurance Is So Important

A decision tree can aid in the selection process by guiding you through different scenarios. It allows you to consider various factors and arrive at a decision that aligns with your unique needs.

| Factor | Options | Decision |

|---|---|---|

| Financial Situation | High Income, Low Debt / Low Income, High Debt | Higher coverage, more comprehensive policy / Lower coverage, simpler policy |

| Personal Needs | Large Family, High Debt / Small Family, Low Debt | Higher coverage / Lower coverage |

| Future Goals | Retirement Planning / Educational Funds | Policy with cash value accumulation / Policy with higher coverage |

| Coverage Amount, Premiums, Terms | High Coverage, High Premiums, Long Term / Low Coverage, Low Premiums, Short Term | Evaluate long-term financial implications / Evaluate short-term financial impact |

Insurance Costs and Affordability

Understanding the cost of life insurance is crucial for making informed decisions. Premiums, the regular payments you make, vary significantly based on several factors. This section will explore strategies for managing costs, the influence of lifestyle and health, and options for securing affordable coverage. Ultimately, the goal is to find a policy that meets your needs without placing undue financial strain on your budget.Life insurance premiums are influenced by a multitude of factors, creating a complex interplay of variables.

This complexity requires a thorough understanding of the key drivers to ensure financial preparedness. Finding the right balance between protection and affordability is essential.

Strategies to Manage Life Insurance Costs

Effective strategies for managing life insurance costs are essential for ensuring financial security without unnecessary financial burdens. A thoughtful approach can help maintain a balance between coverage and affordability. These strategies include:

- Shopping Around: Comparing quotes from multiple insurers is crucial. Different companies have varying pricing structures and policies. Thorough research can lead to significant savings.

- Considering Different Policy Types: Term life insurance, often the more affordable option, provides coverage for a specific period. Whole life insurance, while often more expensive, offers both insurance and investment features.

- Increasing Your Coverage Over Time: Life insurance needs may evolve as your circumstances change. Regularly reviewing your coverage requirements and adjusting accordingly can avoid unnecessary premium payments.

- Paying Premiums Annually: Some insurers offer discounts for annual payments compared to monthly payments. This can result in substantial savings over time.

Impact of Lifestyle Choices and Health Conditions

Lifestyle choices and health conditions directly impact life insurance premiums. These factors are carefully evaluated by insurance companies when assessing risk. Understanding how these elements affect pricing is crucial for proactive decision-making.

- Smoking: Smokers often pay significantly higher premiums than non-smokers. Quitting smoking can lead to substantial premium reductions over time.

- Weight: Individuals with a higher Body Mass Index (BMI) generally face higher premiums. Maintaining a healthy weight can help lower costs.

- Pre-existing Conditions: Conditions like diabetes or heart disease can affect premiums. Insurers often use medical underwriting to assess the risk associated with these conditions.

- Lifestyle Activities: High-risk activities like skydiving or competitive racing can lead to higher premiums. Choosing a lower-risk lifestyle may result in reduced costs.

Options for Reducing Premiums or Obtaining Affordable Coverage

Various options exist for reducing premiums or obtaining affordable coverage. Finding suitable options is often a matter of considering the circumstances and preferences.

- Lowering Coverage Amounts: If your needs are lower than the initial amount, consider decreasing the coverage. A more tailored policy often equates to more affordable premiums.

- Using a Healthier Lifestyle: Improving lifestyle choices like diet, exercise, and quitting smoking can contribute to lower premiums over time.

- Applying for Discounts: Some insurers offer discounts for specific criteria, such as having a safe driving record or owning a home.

- Considering Term Life Insurance: Term life insurance provides coverage for a specific period, often at a lower premium than whole life insurance.

Comparing Life Insurance Quotes

Comparing life insurance quotes is a crucial step in securing the most suitable coverage. A systematic approach to comparing quotes can save significant money.

- Using Online Comparison Tools: Online platforms allow easy comparisons of quotes from multiple insurers.

- Requesting Quotes Directly from Insurers: Directly contacting insurers allows for personalized inquiries and potentially tailored quotes.

- Considering Policy Features: A detailed understanding of coverage amounts, policy terms, and premium structures is crucial.

- Evaluating Provider Reputation and Stability: Assessing the financial strength and reputation of the insurer is essential for long-term financial security.

Long-Term Financial Security

Life insurance plays a crucial role in securing long-term financial stability for individuals and their families. It provides a safety net, ensuring that loved ones are protected financially even in the event of the policyholder’s unexpected death. This security extends beyond immediate needs, offering a foundation for future financial well-being.A life insurance policy acts as a powerful tool for long-term financial planning, mitigating potential risks and building a secure financial future.

By providing a lump-sum payment to beneficiaries, life insurance safeguards against the financial strain of lost income, funeral expenses, and other related costs. This, in turn, creates a strong foundation for future generations.

Impact on Beneficiary Financial Stability

Life insurance policies offer a significant financial cushion for beneficiaries, especially during a period of transition and grief. The funds received can be used to cover essential expenses, such as mortgage payments, education costs, or maintaining a standard of living. This financial stability allows beneficiaries to focus on adjusting to the changes brought about by the policyholder’s passing, without the added burden of immediate financial pressures.

For example, a family with a deceased breadwinner can utilize the life insurance payout to cover the mortgage, tuition fees, and daily living expenses, ensuring a smooth transition.

Securing Future Financial Stability

Life insurance empowers individuals to plan for the long-term financial well-being of their loved ones. By providing a substantial sum of money, life insurance allows beneficiaries to make informed financial decisions and achieve long-term goals. This might include funding children’s education, starting a business, or building a retirement nest egg. These possibilities demonstrate how life insurance investments contribute to a more secure financial future for future generations.

For instance, a parent using life insurance proceeds to fund a child’s college education provides them with a significant advantage in their future endeavors.

Protecting Future Generations

Life insurance is not just about immediate financial security; it also safeguards the financial well-being of future generations. The funds from a life insurance policy can be strategically invested to grow over time, providing a substantial inheritance for future heirs. This long-term financial security can help them start their own lives with a stable foundation, enabling them to pursue their goals and ambitions without the immediate pressures of financial insecurity.

For example, the proceeds from a life insurance policy invested wisely over many years can provide a significant inheritance that can cover the costs of higher education or even establish a small business for the beneficiaries.

Timeline of Life Insurance’s Contribution to Long-Term Financial Security

| Year | Event | Impact on Long-Term Financial Security |

|---|---|---|

| Present | Policy purchase | Foundation for future financial security is established. |

| Years 1-5 | Policy accumulation (if applicable) | Growth of policy value starts; planning for future goals becomes possible. |

| Years 5-10+ | Policy maturing | Potential for substantial financial growth. Funds are available to meet long-term financial obligations. |

| Event of Death | Policy payout | Immediate financial security for beneficiaries, supporting long-term goals and plans. |

Illustrative Scenarios: Why Life Insurance Is So Important

Understanding the profound impact of life insurance often requires looking at real-world examples. These scenarios highlight how life insurance provides more than just financial protection; it offers peace of mind and a safety net for families facing unexpected hardship. By examining these case studies, we can better grasp the value of this crucial financial instrument.

Real-Life Examples of Life Insurance Assistance

Life insurance has played a vital role in supporting countless families during times of loss and transition. These stories demonstrate the practical and emotional benefits of this important financial tool.

- A young professional, tragically killed in a car accident, left behind a spouse and a young child. The life insurance policy provided a substantial lump sum, enabling the surviving spouse to cover the child’s education expenses and maintain a stable living situation. This ensured the child’s well-being and allowed the family to rebuild their lives without facing significant financial instability.

- A business owner, unexpectedly diagnosed with a terminal illness, utilized a life insurance policy to secure the future of his company. The policy’s death benefit allowed the business to smoothly transition to a new management team, ensuring the continuation of operations and job security for employees. This preserved the business and its value for the future.

- A single parent, facing a debilitating illness, found the life insurance policy to be crucial in maintaining their family’s standard of living. The death benefit provided a safety net, allowing the family to continue with essential services and medical treatments, ensuring a smooth transition and continuity for the children.

Case Study: The Miller Family

The Miller family exemplifies the critical role of life insurance in safeguarding future well-being. Mr. Miller, a family man with three young children, understood the importance of financial security for his loved ones. He purchased a life insurance policy that provided a substantial death benefit. Tragically, Mr.

Miller passed away unexpectedly, leaving behind his wife and three young children. The life insurance payout allowed the family to cover essential expenses like mortgage payments, tuition fees, and daily living costs. The family was able to maintain their standard of living, allowing the children to continue their education without facing financial hardship. The emotional distress of the loss was lessened, thanks to the financial support provided by the insurance policy.

This example underscores the crucial role of life insurance in providing not only financial security but also emotional support during times of grief and transition.

Life Insurance in Times of Crisis

The financial and emotional impact of unforeseen circumstances can be devastating. Life insurance offers a critical safety net during times of crisis. The following scenarios illustrate the importance of life insurance in providing immediate support.

- A family business owner facing unforeseen medical expenses can leverage life insurance benefits to ensure the business’s survival and the family’s financial stability. The policy’s death benefit can be used to cover ongoing expenses and maintain a stable financial footing for the business.

- A young professional diagnosed with a terminal illness, needing expensive treatments, can use life insurance to secure the future for their loved ones. The policy’s payout can cover medical expenses, provide for future care, and ensure the financial well-being of the family.

- A self-employed individual, facing unexpected unemployment, can utilize a life insurance policy to provide a safety net for their dependents. The policy’s payout can help bridge the gap until new employment is secured.

Emotional and Practical Benefits

Life insurance offers more than just financial security; it provides profound emotional relief and support. This emotional support is invaluable during times of grief and transition.

The peace of mind knowing that your family will be financially secure in the event of your passing is priceless.

This emotional aspect of life insurance can reduce stress and anxiety, enabling families to focus on healing and rebuilding their lives. The practical benefits, such as the financial security provided by the death benefit, further enhance the overall value and importance of life insurance.

Last Recap

In conclusion, understanding the significance of life insurance extends beyond mere financial planning; it’s about securing your loved ones’ future, streamlining estate management, and achieving personal objectives. By carefully evaluating the different types of policies, associated costs, and potential benefits, individuals can make informed decisions that align with their unique circumstances and aspirations. This comprehensive overview serves as a starting point for a deeper exploration of how life insurance can be a cornerstone of financial well-being and peace of mind.

Expert Answers

What are the different types of life insurance policies?

Common types include term life insurance, which provides coverage for a specific period, and whole life insurance, which offers lifetime coverage and a cash value component. Other types exist, each with unique features and benefits.

How much life insurance do I need?

This depends on various factors, including your financial obligations, family responsibilities, and desired level of protection. Consult with a financial advisor to determine an appropriate coverage amount.

What are the costs associated with life insurance?

Life insurance premiums vary depending on factors like age, health, and coverage amount. Lifestyle choices and pre-existing conditions can also influence premiums.

How does life insurance help with estate planning?

Life insurance proceeds can be used to cover estate taxes, fund charitable donations, and ensure a smooth transition of assets, thereby reducing potential complications and maximizing the value of your estate.