Commercial Real Estate

Commercial Real Estate encompasses a diverse range of properties, from office spaces to retail outlets and industrial warehouses. Understanding the nuances of this market is crucial for both investors and stakeholders. This guide explores the intricacies of commercial real estate, including market analysis, investment strategies, property types, financing options, development, legal aspects, technology, and sustainability considerations.

This detailed overview provides a thorough examination of the commercial real estate landscape. We’ll delve into market trends, investment strategies, and the specifics of various property types. Furthermore, we’ll analyze financing options, the development process, and the legal and regulatory framework.

Market Overview

The commercial real estate market is a dynamic and multifaceted sector, encompassing a diverse range of property types, from bustling office spaces to sprawling industrial warehouses and vibrant retail hubs. Understanding the current state of the market, alongside future projections, is crucial for investors and stakeholders alike. This overview will delve into the current trends, anticipated developments, and the role of various factors in shaping the commercial real estate landscape.The commercial real estate market is influenced by a complex interplay of economic forces, technological advancements, and demographic shifts.

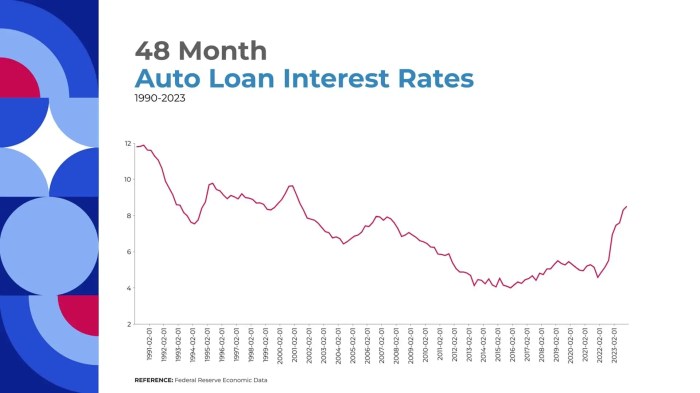

Economic conditions, such as interest rates and overall GDP growth, significantly impact demand and pricing. Technological advancements are reshaping the way businesses operate and utilize space, prompting the need for adaptable and innovative properties. Demographic shifts, including population growth and migration patterns, are crucial factors in the demand for different property types in various locations.

Current Market Trends

The current commercial real estate market is experiencing a period of transition, driven by evolving consumer preferences, technological advancements, and shifts in the global economy. Office spaces are seeing a resurgence in certain areas, particularly in urban centers that offer a blend of work-life balance and amenities. Retail spaces are adapting to the rise of e-commerce by incorporating more mixed-use elements and community-focused features.

Industrial properties continue to be in high demand, fueled by the growth of e-commerce and logistics. This is particularly true in strategically located areas with access to transportation networks.

Projections for the Next 5 Years

Forecasts for the next five years indicate a continued evolution of the commercial real estate market. Economic conditions are expected to influence investment decisions, with fluctuating interest rates potentially impacting market activity. Technological advancements will likely drive the need for adaptable and flexible spaces, while demographic shifts will influence the demand for different property types in specific geographic locations.

For example, the growing demand for industrial space in areas with robust logistics infrastructure suggests a continued need for warehousing and distribution centers. Similarly, the increasing preference for urban living in certain cities is driving demand for office spaces with amenities and flexible layouts.

Successful Investment Examples

Successful commercial real estate investments often hinge on thorough market analysis and a keen understanding of long-term trends. For instance, investments in logistics hubs in areas experiencing significant e-commerce growth have often proven lucrative. Similarly, well-positioned retail properties in areas with high foot traffic and a growing population have yielded substantial returns. Examples include the successful redevelopment of older office buildings in urban centers, incorporating modern amenities and flexible layouts to attract a diverse tenant base.

Such proactive strategies can maximize the potential of existing properties in dynamic markets.

Role of Government Policies and Regulations

Government policies and regulations play a significant role in shaping the commercial real estate market. Zoning regulations, building codes, and tax incentives influence the development and utilization of various property types. For example, tax incentives for sustainable development can encourage the construction of environmentally friendly buildings, positively impacting both the market and the environment. Similarly, changes in zoning regulations can alter the permitted use of properties, thereby affecting demand and pricing.

Performance Comparison of Property Types (Past Decade)

| Property Type | Average Return on Investment (ROI) | Growth Rate (%), Compound Annual Growth Rate (CAGR) | Sensitivity to Economic Conditions |

|---|---|---|---|

| Office | 6.5% | 2.8% | Moderate |

| Retail | 7.2% | 3.5% | High |

| Industrial | 8.1% | 4.2% | Low |

The table above presents a comparative analysis of average ROI and growth rates for different property types over the past decade. The data highlights the varying levels of sensitivity to economic fluctuations among these property types.

Investment Strategies

Commercial real estate investment offers diverse strategies, each with its own risk-reward profile. Understanding these strategies and the factors influencing investor decisions is crucial for navigating the complexities of this market. Successful investments hinge on thorough market analysis, meticulous due diligence, and a clear understanding of the financial metrics that drive profitability.Investors in commercial real estate employ various strategies, tailored to their risk tolerance, return expectations, and market outlook.

These strategies can range from conservative core plus investments to more aggressive value-add or opportunistic ventures. Careful consideration of these elements is essential for a successful investment.

Value-Add Strategies

Value-add strategies focus on improving a property’s value through renovations and upgrades. This approach requires identifying properties with untapped potential and implementing improvements to enhance rental income or market appeal. These strategies can be highly profitable, but also carry greater risk than core plus or opportunistic strategies due to the uncertainties involved in cost estimations and project timelines.

Successful examples include renovating outdated retail spaces to attract modern tenants or upgrading outdated apartments to enhance tenant desirability.

Opportunistic Strategies

Opportunistic strategies capitalize on market anomalies or distressed situations. These strategies often involve purchasing properties at a significant discount, leveraging market conditions for rapid appreciation. This approach can lead to substantial returns, but requires keen market analysis, the ability to quickly assess distressed properties, and a willingness to manage higher-than-average risks. Examples include acquiring properties during economic downturns or buying properties in rapidly growing neighborhoods.

Core Plus Strategies

Core plus strategies target properties in stable, established markets. These properties often require minimal renovation or improvement. Investors in this strategy seek predictable returns and relatively lower risk. Core plus investments tend to generate stable cash flow and are less dependent on market fluctuations. An example would be purchasing a well-maintained office building in a thriving business district.

Factors Influencing Investment Decisions

Investors consider several factors when making decisions, including risk tolerance, return expectations, and market analysis. Risk tolerance dictates the level of uncertainty an investor is willing to accept. Higher risk tolerance may lead to opportunistic strategies, while lower tolerance may lead to core plus investments. Return expectations define the desired financial yield, impacting the investment strategies chosen.

Market analysis provides insights into the current market conditions and future prospects.

Market Analysis and Due Diligence

Thorough market analysis is paramount. This involves understanding local market trends, tenant demand, and comparable property valuations. Due diligence is crucial for identifying potential risks and ensuring the property meets investor expectations. Due diligence encompasses reviewing property documents, conducting site inspections, and assessing financial performance.

Key Financial Metrics for Evaluation

| Metric | Description | Importance |

|---|---|---|

| Cap Rate | Capitalization Rate; the ratio of net operating income to property value. | Indicates potential return on investment. |

| Net Operating Income (NOI) | Annual income generated by the property after operating expenses. | Measures the property’s profitability. |

| Debt Service Coverage Ratio (DSCR) | Measures the property’s ability to cover debt obligations. | Indicates the property’s financial strength. |

| Gross Rent Multiplier (GRM) | Ratio of property value to gross annual rental income. | Quick measure of property value relative to rental income. |

| Vacancy Rate | Percentage of time a property remains unoccupied. | Indicates potential revenue loss. |

Thorough evaluation of these metrics is critical for making informed investment decisions.

Property Types

Commercial real estate encompasses a diverse range of property types, each with unique characteristics, market dynamics, and investment opportunities. Understanding the nuances of these types is crucial for informed decision-making in the sector. This section will delve into the specifics of office, retail, industrial, and multifamily properties, highlighting their key attributes and investment considerations.Different commercial property types cater to distinct market needs and offer varying levels of profitability.

Analyzing their individual strengths and weaknesses, alongside the prevailing tenant demand, is essential for assessing investment potential and identifying successful strategies.

Office Properties

Office properties are typically characterized by their suitability for businesses requiring workspace and amenities. These spaces are often designed to support various functions, including administrative tasks, meetings, and collaboration.

- Location and Accessibility: Proximity to public transportation, amenities, and other businesses are crucial factors influencing demand and rental rates. For example, offices in urban centers with high accessibility often command higher rents compared to suburban locations.

- Building Amenities: Modern office spaces are frequently equipped with high-speed internet, advanced security systems, and collaborative work areas. Well-equipped buildings tend to attract higher-quality tenants.

- Tenant Demand and Market Value: The demand for office space is directly correlated with the overall economic climate and specific industry trends. A thriving tech sector, for instance, can significantly boost demand for office space in areas catering to that industry. The occupancy rate and lease terms are strong indicators of the property’s health and profitability.

- Successful Tenant Mix Strategies: A diverse tenant mix, including a balance of established businesses and emerging companies, can enhance the overall property value. Attracting businesses that complement each other in terms of services and clientele can lead to a more robust and sustainable environment for the entire complex.

Retail Properties

Retail properties cater to the needs of consumers by providing spaces for businesses to showcase and sell their products or services. The success of a retail property often hinges on the types of stores and their appeal to the target demographic.

- Target Market and Demographics: The viability of a retail property depends on the characteristics of the surrounding community and the preferences of the target consumer base. Understanding the demographics of the area helps in attracting retailers that resonate with the specific market needs.

- Foot Traffic and Visibility: High foot traffic and prominent visibility are critical factors for retail properties. The location’s accessibility and visibility from major thoroughfares or public areas are crucial determinants of its success.

- Retail Mix and Variety: A well-balanced mix of retail businesses, including complementary and diverse options, can enhance the appeal and profitability of a property. A successful retail mix caters to a broad range of consumer needs.

- Successful Tenant Mix Strategies: Combining different retail formats can create a more appealing and vibrant environment. A mix of restaurants, clothing stores, and entertainment venues, for example, can generate significant foot traffic and attract a wider range of customers.

Industrial Properties

Industrial properties are designed to accommodate businesses involved in manufacturing, warehousing, or distribution activities. These properties prioritize factors such as accessibility, space, and logistics.

- Accessibility and Logistics: Proximity to transportation networks, such as highways, rail lines, and ports, is crucial for industrial properties. Efficient logistics are essential for receiving and distributing goods.

- Size and Flexibility: The demand for industrial space often involves various sizes and layouts. Flexibility in terms of space allocation is a key factor in attracting tenants.

- Tenant Demand and Market Value: The demand for industrial properties is heavily influenced by broader economic trends, such as manufacturing output and supply chain dynamics. A surge in e-commerce, for instance, can significantly increase demand for warehousing space.

- Successful Tenant Mix Strategies: Industrial properties often have limited tenant mix strategies. Instead, the focus is on attracting tenants with similar needs and operations, like manufacturers or distributors of similar products.

Multifamily Properties

Multifamily properties encompass residential units, such as apartments or condominiums. These properties cater to a diverse range of demographics, from young professionals to families.

- Target Demographics: Understanding the demographic needs and preferences of the target renters is critical for successful multifamily investments. This includes factors like household size, income levels, and lifestyle preferences.

- Amenities and Features: The inclusion of desirable amenities, such as swimming pools, fitness centers, and laundry facilities, can attract renters and increase rental rates.

- Market Value and Rent Levels: The location, amenities, and overall condition of a multifamily property directly impact rental rates. High-demand locations with desirable amenities generally command higher rent levels.

- Successful Tenant Mix Strategies: While diversity in tenant types is desirable, focusing on a mix that balances different needs, like families and young professionals, can create a harmonious living environment and a stable rental income.

Financing Options: Commercial Real Estate

Securing appropriate financing is critical for successful commercial real estate acquisitions and developments. The availability and terms of financing significantly impact project feasibility and profitability. Understanding the various options, lender roles, and influencing factors is paramount for informed decision-making.Commercial real estate financing encompasses a spectrum of instruments and strategies, each tailored to specific project requirements and investor profiles.

The process often involves intricate negotiations and due diligence to align the financing structure with the long-term goals of the project.

Available Financing Options

A multitude of financing options are available to support commercial real estate transactions. These options vary significantly in terms of their structure, risk profile, and suitability for different projects. Understanding these distinctions is crucial for making informed financial decisions.

- Mortgages: Traditional mortgages, secured by the property, remain a common financing source for commercial real estate. These loans typically involve a fixed or adjustable interest rate and a predetermined repayment schedule. Lenders assess the property’s value, the borrower’s creditworthiness, and market conditions to determine loan terms and interest rates.

- Mezzanine Financing: Mezzanine financing sits between debt and equity financing, providing additional capital beyond traditional mortgages. This structure often carries a higher interest rate and risk than traditional mortgages, but can be attractive for projects with limited equity availability.

- Equity Investments: Equity investors provide capital in exchange for an ownership stake in the project. This option often carries a higher risk but offers potential for higher returns, particularly in successful projects.

- Government Programs: Various government programs offer incentives and financing options for specific types of commercial real estate projects, such as affordable housing or renewable energy initiatives. These programs can be valuable for projects that align with public policy goals.

- Construction Financing: Construction loans are tailored to fund the development phase of a project, providing funds for land acquisition, design, construction, and permits. These loans are typically short-term and secured by the property, with interest rates usually higher than traditional mortgages.

Role of Lenders and Investors

Lenders and investors play crucial roles in the financing process. Lenders assess the risk associated with the project and the borrower’s creditworthiness to determine the loan terms. Investors consider the project’s potential returns, market conditions, and overall risk to evaluate investment opportunities.

- Lenders: Lenders, such as banks, credit unions, and specialized commercial lenders, assess the financial health of the borrower and the viability of the project. They scrutinize the property’s value, market conditions, and the borrower’s financial history to determine the loan amount and interest rate.

- Investors: Investors, including private equity firms, hedge funds, and individual investors, evaluate the potential returns of the investment and the project’s long-term viability. Their decision-making often hinges on factors like market trends, projected cash flow, and the overall risk profile of the project.

Factors Influencing Loan Approval and Interest Rates

Several key factors influence loan approval decisions and interest rates. A comprehensive evaluation of these factors is crucial for a successful financing process.

- Property Value: The appraised value of the property significantly impacts the loan amount and interest rate. A higher appraised value typically translates to a larger loan and potentially lower interest rates.

- Creditworthiness: The borrower’s credit history and financial stability play a vital role in the lender’s assessment. A strong credit profile usually leads to more favorable loan terms.

- Market Conditions: Economic conditions, interest rates, and market trends in the commercial real estate sector influence loan approvals and interest rates.

- Project Details: The specifics of the project, including its location, use, and projected profitability, are critical considerations for lenders.

Different Financing Instruments

Various financing instruments are available, each with distinct characteristics and applications. Selecting the appropriate instrument is essential for aligning financing with project requirements.

| Financing Instrument | Description | Pros | Cons |

|---|---|---|---|

| Mortgages | Traditional loans secured by the property. | Relatively low interest rates, established process. | Potential for higher interest rates during challenging economic times. |

| Mezzanine Financing | Hybrid financing between debt and equity. | Provides additional capital beyond mortgages, potentially suitable for projects with limited equity. | Higher interest rates and risk compared to traditional mortgages. |

| Equity Investments | Investors provide capital in exchange for an ownership stake. | Potential for higher returns, diverse capital sources. | Higher risk, dilution of ownership. |

Development and Construction

Commercial real estate development is a complex process requiring meticulous planning, execution, and management. From initial site selection to final occupancy, successful development hinges on understanding market demands, navigating regulatory hurdles, and managing financial resources effectively. The successful completion of a project often depends on the expertise of architects, engineers, and contractors, each playing a vital role in bringing the vision to fruition.The development of a commercial property involves a phased approach, encompassing meticulous research, meticulous design, and rigorous adherence to legal and regulatory standards.

This process necessitates a deep understanding of local zoning regulations, environmental considerations, and market analysis. Effective project management is critical for ensuring the project remains on schedule and within budget. Understanding the various challenges and opportunities inherent in each phase is crucial for success.

Site Selection and Due Diligence

Careful site selection is paramount in the development process. Factors like accessibility, zoning regulations, and proximity to infrastructure are key considerations. Thorough due diligence, including environmental assessments and legal reviews, is essential to mitigate potential risks and ensure the project’s viability. This meticulous approach minimizes unforeseen challenges and safeguards the investment.

Design and Planning

The design phase involves creating a comprehensive architectural and engineering plan, considering factors such as building codes, sustainability requirements, and tenant needs. This crucial phase requires input from architects, engineers, and potentially market research to ensure the design aligns with the intended use and target market. Effective design reduces future costs and improves long-term performance.

Permitting and Approvals

Securing necessary permits and approvals is a crucial step in the development process. Navigating the complex regulatory landscape requires a deep understanding of local ordinances and building codes. A smooth permitting process ensures compliance and minimizes potential delays and legal challenges. This stage often involves interaction with local authorities, ensuring the project aligns with community needs.

Construction Management

Effective construction management is essential for timely and cost-effective project completion. This involves selecting qualified contractors, overseeing construction activities, and ensuring compliance with project specifications. Proactive risk management strategies are critical for mitigating potential delays and cost overruns. This phase requires close monitoring of timelines, budgets, and quality control.

Financing and Funding

Securing the necessary funding for development is a crucial aspect of the process. Various financing options, such as loans, equity investments, and government grants, are available to developers. A robust financial plan, outlining project costs and projected returns, is essential to secure funding. Access to capital and understanding of financial models are critical for success.

Challenges and Opportunities

Development projects often face challenges, including fluctuating interest rates, material price increases, and regulatory hurdles. However, opportunities exist in emerging markets, niche property types, and innovative construction techniques. Market analysis and adaptability are crucial for mitigating risks and seizing opportunities. Identifying and addressing these challenges proactively can significantly enhance the chances of success.

Successful Development Projects

Examples of successful development projects include the construction of modern office complexes in urban areas, high-rise residential buildings in prime locations, and mixed-use developments catering to diverse needs. These projects demonstrate the potential for profitable returns and community benefit.

Role of Professionals

Architects, engineers, and contractors play critical roles in the development process. Architects design the building to meet functional and aesthetic requirements. Engineers ensure structural integrity and compliance with building codes. Contractors oversee the construction process, ensuring quality and adherence to schedules. Their collaborative efforts are essential for project success.

Stages of Commercial Real Estate Development

| Stage | Description |

|---|---|

| Site Selection & Due Diligence | Identifying suitable locations, assessing market demand, and conducting thorough site analysis. |

| Design & Planning | Developing architectural and engineering plans, considering regulations and tenant needs. |

| Permitting & Approvals | Obtaining necessary permits and approvals from local authorities. |

| Financing & Funding | Securing necessary capital through loans, equity, or grants. |

| Construction Management | Overseeing the construction process, ensuring quality, timelines, and budget adherence. |

| Marketing & Leasing | Promoting the property to potential tenants and managing the leasing process. |

| Occupancy & Management | Handling tenant relations, maintenance, and property operations. |

Legal and Regulatory Aspects

Navigating the commercial real estate landscape requires a strong understanding of the legal and regulatory frameworks that govern transactions. These frameworks, often complex and nuanced, vary by jurisdiction and can significantly impact investment decisions, development strategies, and the overall success of a project. Thorough legal due diligence and a keen awareness of potential legal pitfalls are crucial for minimizing risks and maximizing returns.Understanding the intricacies of local zoning regulations and building codes is equally vital.

These regulations shape the permissible uses and development potential of a property, impacting both the feasibility and profitability of a project. Failure to comply can lead to costly delays, permit denials, or even legal challenges. This section will provide an overview of critical legal considerations for commercial real estate professionals.

Legal Frameworks Governing Commercial Real Estate Transactions

Commercial real estate transactions are governed by a complex web of federal, state, and local laws. These laws address property ownership, transfer, financing, leasing, and development. Specific legislation often impacts aspects like environmental regulations, building codes, zoning ordinances, and property tax assessments. Understanding the nuances of these laws is critical for informed decision-making.

Importance of Legal Counsel and Due Diligence

Legal counsel plays a critical role in navigating the complexities of commercial real estate transactions. Experienced attorneys can provide expert guidance on the legal implications of various transactions, advise on potential risks, and help structure transactions to minimize liability. Thorough due diligence is equally crucial, encompassing title searches, environmental assessments, and analyses of existing leases and encumbrances. This proactive approach helps identify potential problems before they arise, saving significant time and resources.

Examples of Legal Issues and Disputes in Commercial Real Estate

Disputes frequently arise in commercial real estate, stemming from various sources. These include disagreements over lease terms, construction defects, property boundary issues, and environmental contamination. For example, a landlord might dispute a tenant’s claim of constructive eviction, or a developer might face legal challenges regarding zoning violations. Careful contract negotiation and comprehensive due diligence are essential to mitigating these risks.

Impact of Local Zoning Regulations and Building Codes

Local zoning regulations and building codes have a profound impact on commercial real estate projects. These regulations often dictate permissible land uses, building heights, setbacks, and density. Building codes specify construction standards and safety requirements, affecting design and construction. Non-compliance can lead to significant penalties and delays. A detailed understanding of applicable zoning regulations and building codes is essential before initiating any development or construction project.

Structuring a Commercial Lease Agreement

A well-structured commercial lease agreement is critical for defining the rights and responsibilities of both the landlord and tenant. The agreement should clearly Artikel the terms of the lease, including the lease term, rent payments, security deposit, use restrictions, and provisions for default. Key clauses should include definitions of responsibilities for repairs, maintenance, and property improvements. A comprehensive lease agreement protects both parties and minimizes potential disputes.

- Clearly defining responsibilities for repairs, maintenance, and property improvements.

- Specifying procedures for rent increases or lease renewals.

- Outlining provisions for termination or breach of the agreement.

- Including clauses addressing property taxes, insurance, and other financial obligations.

Technology and Innovation

Technological advancements are rapidly reshaping the commercial real estate landscape, impacting every facet from market analysis to tenant experiences. This transformation is driven by a convergence of digital tools, data analytics, and innovative platforms, leading to increased efficiency, improved decision-making, and a more dynamic market. The integration of technology is not just a trend, but a fundamental shift that is fundamentally altering how commercial real estate is acquired, managed, and utilized.

Impact on Market Analysis

Data analytics and advanced algorithms are revolutionizing market analysis in commercial real estate. Sophisticated software platforms now aggregate and process vast amounts of data, from market trends to tenant demographics. This allows for a deeper understanding of market conditions, enabling investors to make more informed decisions about property valuations, potential returns, and investment strategies. Real-time data dashboards provide a comprehensive view of market dynamics, allowing for quicker responses to emerging opportunities and challenges.

Impact on Property Management

Technology significantly streamlines property management tasks. Automated building management systems (BMS) control and optimize energy consumption, security systems, and maintenance schedules, leading to cost savings and improved operational efficiency. Tenant communication and service requests are often handled through user-friendly online portals, improving responsiveness and enhancing tenant satisfaction. Furthermore, property managers can leverage data-driven insights to optimize lease terms, predict potential vacancies, and proactively address maintenance needs.

Impact on Tenant Experience

Technology plays a critical role in enhancing the tenant experience. Smart building features like access control, lighting, and climate control systems offer tenants greater convenience and control over their workspace. Digital communication platforms streamline tenant interactions, enabling quick responses to inquiries and efficient management of service requests. Interactive building maps, real-time occupancy data, and virtual tours contribute to a more engaging and intuitive tenant experience, attracting and retaining high-quality tenants.

Emerging Technologies

Several emerging technologies are poised to further transform the commercial real estate industry. Virtual reality (VR) and augmented reality (AR) are being employed for virtual property tours, allowing potential tenants and investors to experience spaces remotely. The use of blockchain technology has the potential to enhance transparency and security in transactions. The Internet of Things (IoT) sensors are gathering data to optimize building operations and maintenance schedules.

These technologies hold immense potential to improve efficiency, reduce costs, and enhance the overall experience for all stakeholders.

Examples of Successful Applications

Numerous examples illustrate the successful integration of technology in commercial real estate. A prominent example is the use of AI-powered tools for predictive maintenance, reducing downtime and minimizing unexpected repairs. Another successful implementation is the use of data analytics for optimizing lease terms and maximizing property values. These are just a few examples of how technology is transforming commercial real estate operations and driving significant improvements in efficiency, productivity, and profitability.

Sustainability and ESG Factors

Commercial real estate is increasingly recognizing the critical role of sustainability and environmental, social, and governance (ESG) factors in long-term value creation. Integrating these factors into investment strategies and operations is no longer a niche preference but a fundamental requirement for attracting investors and ensuring the resilience of portfolios. The evolving regulatory landscape and investor demand are driving this shift, placing a premium on properties that demonstrate a commitment to responsible practices.A growing number of investors are incorporating ESG criteria into their investment decisions, considering the environmental impact, social responsibility, and corporate governance of real estate projects.

This includes assessing energy efficiency, water conservation, waste management, and the social impact of a property on surrounding communities. The long-term financial viability of a property is increasingly tied to its sustainability profile.

Importance of Sustainability in Commercial Real Estate

Sustainability in commercial real estate encompasses a broad range of practices aimed at minimizing environmental impact, promoting social responsibility, and enhancing governance. These practices contribute to the long-term financial health and operational efficiency of properties. They enhance the appeal to environmentally conscious tenants and investors. The integration of sustainability measures in a building’s design and operation can lead to reduced operating costs, improved tenant satisfaction, and enhanced property value.

Impact of ESG Factors on Investment Decisions

ESG factors are increasingly influencing investment decisions. Investors are prioritizing properties with strong ESG profiles, recognizing that these factors can contribute to long-term value and risk mitigation. For example, a property with high energy efficiency ratings may attract tenants who value sustainability, leading to higher occupancy rates and rental income. Likewise, a building with a demonstrable commitment to community engagement can attract positive media attention and strengthen its reputation.

Examples of Sustainable Building Practices and Designs, Commercial Real Estate

Sustainable building practices encompass a wide range of design and construction techniques. These practices aim to minimize environmental impact, maximize energy efficiency, and reduce operational costs. Examples include the use of renewable energy sources, such as solar panels or wind turbines; incorporating natural light and ventilation strategies; employing water-efficient fixtures and landscaping; and utilizing recycled or locally sourced materials.

The design of green roofs or walls can also significantly contribute to energy efficiency and improve biodiversity.

Role of Green Certifications in Commercial Real Estate

Green certifications play a crucial role in validating the sustainability of commercial properties. These certifications, such as LEED (Leadership in Energy and Environmental Design), provide a standardized framework for assessing and measuring the environmental performance of buildings. They demonstrate a property’s commitment to sustainable practices and enhance its marketability. Compliance with green building standards often results in improved energy efficiency, reduced operational costs, and increased tenant satisfaction.

Evaluating the Sustainability Performance of a Commercial Property

Evaluating the sustainability performance of a commercial property involves a comprehensive assessment of various factors. This includes examining energy and water consumption, waste management practices, and the building’s overall environmental impact. A thorough evaluation typically considers a property’s carbon footprint, its use of renewable energy, and its adherence to relevant environmental regulations. Metrics such as energy efficiency ratios, water usage per square foot, and waste diversion rates can provide valuable insights into a property’s sustainability performance.

Furthermore, analyzing the property’s social responsibility, such as community engagement initiatives and tenant satisfaction, should also be considered.

Last Recap

In conclusion, navigating the commercial real estate market requires a multifaceted understanding. This guide has provided insights into market analysis, investment strategies, property types, financing, development, legal aspects, technology integration, and sustainability. By understanding these factors, investors and stakeholders can make informed decisions and achieve successful outcomes.

Helpful Answers

What are the key factors influencing loan approval for commercial real estate?

Loan approval for commercial real estate is heavily influenced by factors such as the property’s value, the borrower’s creditworthiness, the loan-to-value ratio, and market conditions. Lenders also scrutinize the property’s potential income streams and the stability of the tenant base.

What are some common legal issues that arise in commercial real estate transactions?

Common legal issues in commercial real estate transactions include lease disputes, property boundary issues, and environmental concerns. Proper due diligence and legal counsel are crucial in mitigating these risks.

How do environmental, social, and governance (ESG) factors affect commercial real estate investments?

ESG factors are increasingly important in commercial real estate investment decisions. Investors are considering factors such as a property’s sustainability practices, its social impact on the community, and the governance structure of the property owner or developer.

What are the different types of financing instruments used in commercial real estate?

Common financing instruments include mortgages, mezzanine financing, and equity investments. The choice of instrument depends on the specific investment strategy, the property’s characteristics, and the investor’s financial goals.